Dave Ramsey’s Baby Steps and Why They Work

by islam ahmed

I am a huge fan of Dave Ramsey’s baby steps from his book, The Total Money Makeover. It was the baby steps that helped us get rid of $52,000 in consumer debt in just 18 months, and we are not the only ones. Millions

of people have taken his course and used them as well, so you can be

confident that if you use these steps, you will build a strong financial

foundation for you and your family.

Today we’re going to go over each step in detail and explain how it is vital

to accelerating your path to financial independence.

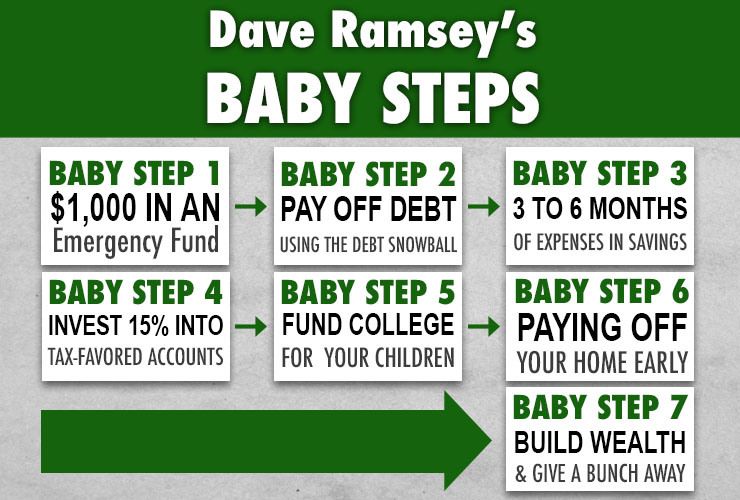

Dave Ramsey’s Baby Steps

- Baby Step 1 – $1,000 in an Emergency Fund

- Baby Step 2 – Pay off all non-mortgage debt using the Debt Snowball

- Baby Step 3 – 3 to 6 months of expenses in savings

- Baby Step 4 – Invest 15% of household income into Roth IRAs and pre-tax retirement

- Baby Step 5 – Funding College for children

- Baby Step 6 – Pay off your home early

- Baby Step 7 – Build wealth and give a bunch away

The Breakdown of Each Step

To help you figure out where you are in the process here is a breakdown of

what each baby step entails.

1. Save $1,000

Dave calls this step the “baby emergency fund”. It might seem silly to sock

a grand in the bank when you could be putting that money toward reducing

debt, but here’s the logic behind this first baby step:

Unexpected expenses happen to everyone, and for some reason they often

tend to happen more when you’ve just committed to getting out of debt. In

order to avoid being tempted to use your credit cards to handle these

unexpected costs, save a quick $1,000 and put it aside as a buffer from

those emergencies.

If in the course of paying off your debt, you have to use some of the money

in your starter emergency fund, you simply stop paying extra on your debt

and put any extra money into your starter emergency fund until it reaches

$1,000 again. This step will help ensure that your credit card balances

continue to go down and not up.

Bonus: The starter emergency fund also serves as training ground for both

paying for emergencies in cash and for developing a habit of saving money.

And, if you grow your emergency fund a little bit more, it can be a way to

started making your money work for you if you open an interest bearing

checking account, like the Radius Hybrid Checking account. The interest

rate is currently 0.85% on balances of $2,500.

2. The Debt Snowball

There’s little doubt that the debt avalanche (paying off debts according to

the highest interest rate) will save money in the long run, but the debt

snowball is often a better choice when it comes to keeping people

motivated for the often long journey of becoming debt free.

With the debt snowball method, you start by listing your debts from

smallest to largest. You make the minimum payment on all debts, putting

any extra funds toward the smallest debt until it’s paid in full.

Then, you take the minimum payment you were paying on the smallest

debt, the minimum payment on the next biggest debt, plus any extra

funds, and put that money toward the next biggest debt until it too is paid off.

This method of keeping your total monthly minimum payments the same

(instead of just coasting with the smaller amount of payments actually due)

combined with adding any extra funds toward the current smallest debt

means that you will pay off your debt at a faster rate.

Bonus: Being able to mark those smaller debts as “Paid in Full” more

quickly will give you more motivation and faith that you can indeed win the

battle against debt.

Download the Debt Snowball form below:

3. Finish the Emergency Fund

Ramsey’s next suggested baby step is to increase your emergency fund

until it contains 3 to 6 months’ worth of expenses for your household. The

way he suggests accomplishing this feat quickly is to take all of the monies

that you were putting toward your debt snowball (which should now be paid

off) and put it toward finishing your emergency fund.

A 3 to 6 month emergency fund will keep you and your family well buffered

against major financial emergencies such as job layoffs and large

unexpected expenses such as major home repairs.

Bonus: Developing a habit of saving BIG money will make it easier for you

to develop a habit of putting money into a separate countdown fund for

expected major expenses.

4. Maximize Retirement Investing

After the consumer debt is gone and the emergency fund is fully funded,

Ramsey suggests maxing out your retirement investing.

For 2016 this means contributing up to the legal maximum allowed by the

IRS of $18,000 a year for 401(k)’s and $5,500 a year for IRAs (Ramsey suggests 15% of your income). Those 50 and over can contribute an

additional $6,000 to their 401(k) and an additional $1,000 to their IRA

holdings.

By maxing out your retirement investing based on your retirement funding

goals, you are ensuring that your golden years will be secure and comfortable.

5. Prepare the Kids’ College Funds

One of the things I like about the college section of the Total Money

Makeover book is that Ramsey is clear that college is not a guaranteed

career success for your kids. He goes into great detail about how important

it is to calculate the cost vs. the benefit of college before you go sending

your kid out to spend $25,000 a year on schooling.

It’s important during this step to talk with your spouse about how much money you can comfortably set aside for your child (ren)’s education.

The dollar amount is totally up to you. Just be sure you research the

different college saving options and make sure that what you’re planning on

contributing to your kids’ college educations is affordable for your family –

and make your plan clear to your kids so they know exactly what to expect

from you where college education help is concerned.

6. Pay off the Home Mortgage

After you’ve paid off all consumer debt, have a fully funded emergency

fund, are contributing at least 15 percent of your income toward

retirement, and have a plan for contributing to your kids’ college

educations, it’s time to dump the mortgage.

Put all extra funds (based on having created a solid budget) toward that

mortgage and get it paid off in full as soon as possible. The less interest

you pay to the bank, the more money you have to give to worthy causes

and to fulfill your dreams, whatever those dreams may be.

7. Build Wealth and Give a Bunch Away

Here’s arguably the best step! Now that you owe no money to anyone and have a nice stockpile of savings, it’s time to start building some serious wealth.

That wealth-building can come in a variety of forms. You can invest in

mutual funds, invest in real estate or simply sock the money away in a

high-interest earning bank.

The goal is to put as much money as possible toward whatever your

financial goals are, whether that means traveling the world, building your

dream home or living life as a philanthropist.

Once you are completely debt free and have amassed a serious amount of

wealth, the world is your oyster and your dreams are unlimited. So start

working the baby steps in your life today, and work toward achieving all of your dreams.

Have you started working Dave Ramsey’s Baby Steps? If so, what was your experience like? Please let us know in the comments below!

No comments:

Post a Comment